The fusion of Artificial Intelligence (AI) trading bots within the domain of cryptocurrency trading is revolutionizing investor interactions with the market. These increasingly sophisticated technologies are transitioning from mere automated tools to essential elements in strategic market engagement. They scrutinize extensive datasets, decode market patterns, and initiate trades with a precision and speed that surpass human capabilities. AI trading bots are pioneering a new era in investment strategies, making high-frequency trading more accessible and efficient, thus broadening its appeal and usability. This leap in technology is leveling the playing field, equipping both experienced and novice traders with powerful tools to enhance their trading outcomes and reshape the cryptocurrency trading landscape.

Understanding AI Crypto Trading Bots

https://www.investopedia.com/how-to-use-artificial-intelligence-in-your-investing-7973810

AI crypto trading bots, a core component of the emerging AI bot trading landscape, are software programs that employ advanced algorithms to automate trading decisions in the cryptocurrency market. Fueled by the engines of machine learning and artificial intelligence, AI trading bots stand at the forefront of data-driven financial strategies in cryptocurrency markets. These bots harness extensive sets of both historical and real-time data to make nuanced trading decisions that often surpass human capabilities.

The core functionality of these bots starts with an extensive data collection phase. They pull information from diverse sources such as market indicators, cryptocurrency price fluctuations, sentiment analysis from social platforms, and pertinent financial news. Sophisticated algorithms then sift through this data to pinpoint market trends, detect underlying patterns, and forecast potential market shifts that might elude human analysts.

The heart of these systems lies in their machine learning models, which not only absorb lessons from historical market behaviors but are also agile enough to adapt to new, unexpected market conditions. This adaptability is crucial for both capitalizing on profitable opportunities and mitigating potential losses, making these bots invaluable for navigating the turbulent waters of cryptocurrency markets.

Integrating these advanced technologies, AI trading bots enhance the precision and efficiency of market analysis, strategy formulation, and trade execution. They offer traders a significant edge by maximizing returns and minimizing risks through smart, data-informed decisions in a market known for its volatility.

The Rise of AI Trading Bots in Crypto Markets

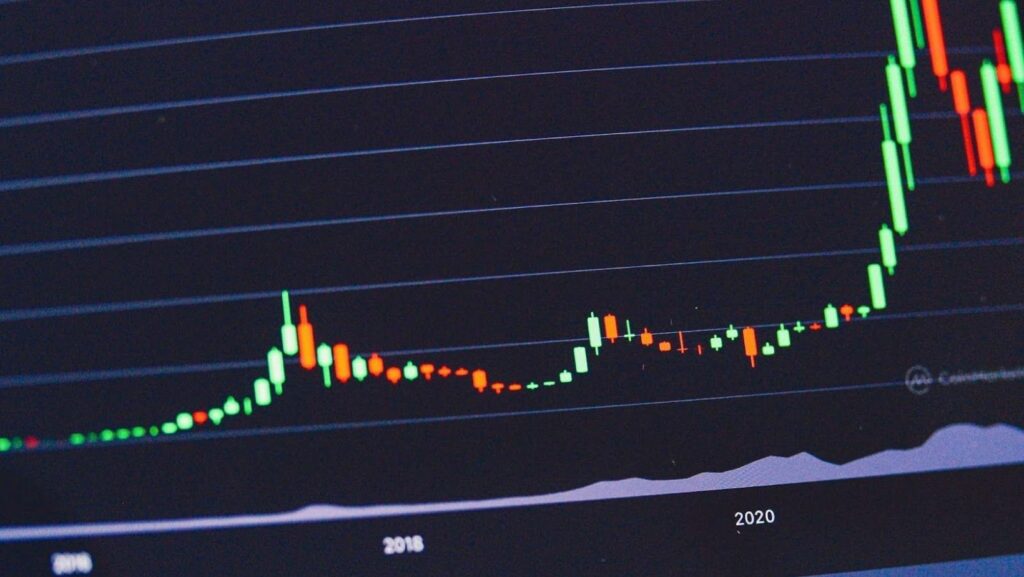

AI trading bots began their journey in the conventional stock markets, employing algorithms to act on specific trading signals. As they evolved, these bots transitioned into the cryptocurrency sector, which presented a new array of challenges including its round-the-clock trading hours and extreme volatility. The need for systems that could continuously monitor and react to the crypto market’s fast-paced environment became evident.

This migration was largely driven by the capabilities of AI bots to perform relentless market analysis and trading—an essential feature in the non-stop crypto market. The adaptability and speed of AI trading bots quickly made them a favorite tool among crypto traders. These traders valued the bots for their efficiency in managing the high volatility and liquidity of the market—conditions that typically challenge human capacity and emotional resilience. AI bots excel in executing rapid trades and leveraging fleeting market opportunities, thus aligning perfectly with the dynamic nature of cryptocurrency trading.

Benefits of AI Trading Bots

AI trading bots transform the landscape of cryptocurrency trading through their relentless operational capabilities. These sophisticated tools tirelessly monitor the crypto market—a space notorious for sudden and dramatic price changes, often occurring during off-hours when manual trading is less feasible. Their 24/7 functionality enables them to capture opportunities and react to shifts the moment they happen, a task unmanageable at such consistency and speed by human traders.

One of the most crucial aspects of AI bots is their ability to detach from the emotional swings that frequently affect human decision-making. Relying strictly on algorithms and predefined parameters, these bots assess and act on market data impartially. This approach removes emotional biases from trading activities, fostering more consistent and strategically sound decision-making, crucial for navigating the volatile swings of the cryptocurrency markets.

Moreover, AI bots come equipped with robust risk management tools that are essential for protecting investments. With functionalities like stop-loss orders and take-profit settings, along with a range of trading strategies, these bots can swiftly adjust to new information and market conditions. This dynamic adjustment helps maintain a favorable balance between risk and reward, shielding investors from drastic losses while enhancing the potential for profit. This proactive risk management contributes significantly to a more disciplined and stable trading environment.

Challenges and Limitations

While AI trading bots represent a significant technological advance in cryptocurrency trading, they are not without their challenges and limitations. One of the primary concerns is their dependence on quality data. These bots require accurate, high-quality data to function effectively; any errors in data feeds can lead to poor trading decisions. Furthermore, the programming of these bots also plays a critical role. Poorly designed algorithms can lead to substantial financial losses, especially in a market as volatile as crypto.

Handling market anomalies poses another significant challenge. AI bots, despite their advanced algorithms, may not adequately react to unprecedented market events, such as sudden regulatory changes or major geopolitical incidents that affect the market. Moreover, the regulatory landscape for cryptocurrency is still evolving, and bots must continuously adapt to comply with new laws and guidelines, which can vary significantly between jurisdictions.

The Future of AI Trading Bots in Crypto Trading

The future of AI trading bots in crypto trading looks promising as advancements in AI and machine learning continue to evolve.

These technologies are expected to become even more sophisticated, allowing trading bots to make more accurate predictions and manage complex trading strategies under varied market conditions. Furthermore, as regulatory frameworks around cryptocurrencies become clearer and more standardized, it will likely enhance the integration of AI bots into mainstream trading platforms, ensuring they operate within legal boundaries and contribute to a more stable crypto trading environment.

Conclusion

AI trading bots hold transformative potential in the crypto market, revolutionizing how trading is executed and managed. As this technology continues to develop, it will further shape the landscape of cryptocurrency trading, making it more accessible, efficient, and secure for traders around the globe. The integration of AI in trading platforms is not just enhancing operational efficiencies but also redefining strategic decision-making in investments. As we look to the future, the symbiosis of AI and cryptocurrency is poised to unlock new opportunities in trading, ensuring that market participants have the tools to thrive in an increasingly complex and dynamic environment. This evolution suggests a promising horizon where AI-driven trading could become the new standard, delivering precision and resilience in market operations.